Three ways you can buy a vehicle through a limited company. Purchasing the vehicle outright. Like acquiring any other asset for your company, you can purchase a vehicle by paying the purchase price in full. This can help simplify your accounting if you’re just starting out as you won’t have to calculate and expense the interest you would.. The steps to calculate BIK tax are as under; Determine the List Price: £25,000. Find the BIK Percentage: Since the CO2 emissions are 120 g/km, the BIK percentage for this car is 30%. Calculate Taxable Value of Car Benefit: Taxable Value = List Price × BIK Percentage. Taxable Value = £25,000 × 0.30 = £7,500.

7 mistakes people make when purchasing car insurance YouTube

How To Guides Purchasing a Car YouTube

Considering The Financing Options For Purchasing A Car The Aspiring Gentleman

Purchasing a Car 101 Cost, Deals, 0 APR YouTube

Woman Purchasing the Car Form Car Dealer Stock Photo Image of sitting, signing 49775680

Leasing an Electric Car Through a Limited Company MCL

Purchasing a New Vehicle? Consider these Tips before You Buy

Buying a Car Through Limited Company in the UK CruseBurke

Purchasing a Van through a Limited Company Guide

Purchasing a Vehicle Solvay Bank

Today, you are purchasing a new car for 27,000. You plan to put… Course Hero

Should I Lease a Car Through My Limited Company or Personally? Lease Fetcher

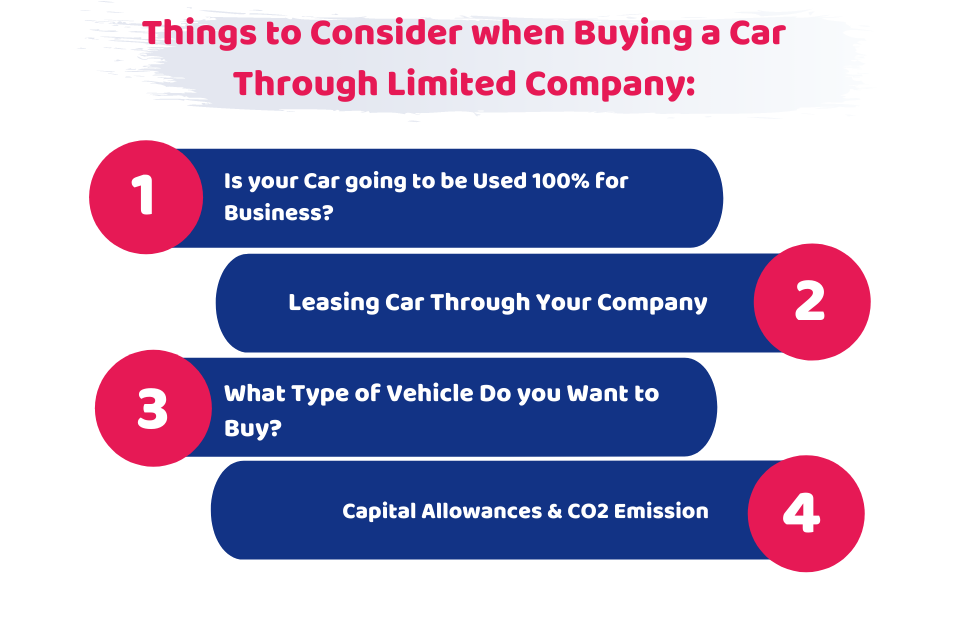

Things to Consider when Buying a Car Through Limited Company

6 Tips for Purchasing a Car This N That with Olivia

Purchasing a New Car Vs Purchasing a used car. BuyingNewCar BuyingUsedCar CarBuyingTips

Things to Consider when Buying a Car Through Limited Company

Tips on Purchasing a Car that was Recalled

Maximizing Benefits Buying a Car Through Your Limited Company

Maximizing Benefits Buying a Car Through Your Limited Company

Buying a SecondHand Car Through a Business or Company

Tax Efficiency. One of the primary advantages of purchasing a car through your limited company is the potential tax benefits. In many jurisdictions, businesses can claim tax deductions on the purchase price, finance costs, insurance, maintenance, and even fuel expenses. This can result in significant savings, as these costs can be treated as.. Car benefit charge example – registered after 6th April 2020. So, for a new car with a £30,000 list price and CO2 emissions of 110g/km, the car benefit charge for 2023/24 is 27% of the list price = £8,100. You then multiply this charge by the personal income tax band the charge will fall into – basic (20%), higher (40%), or additional (45%).