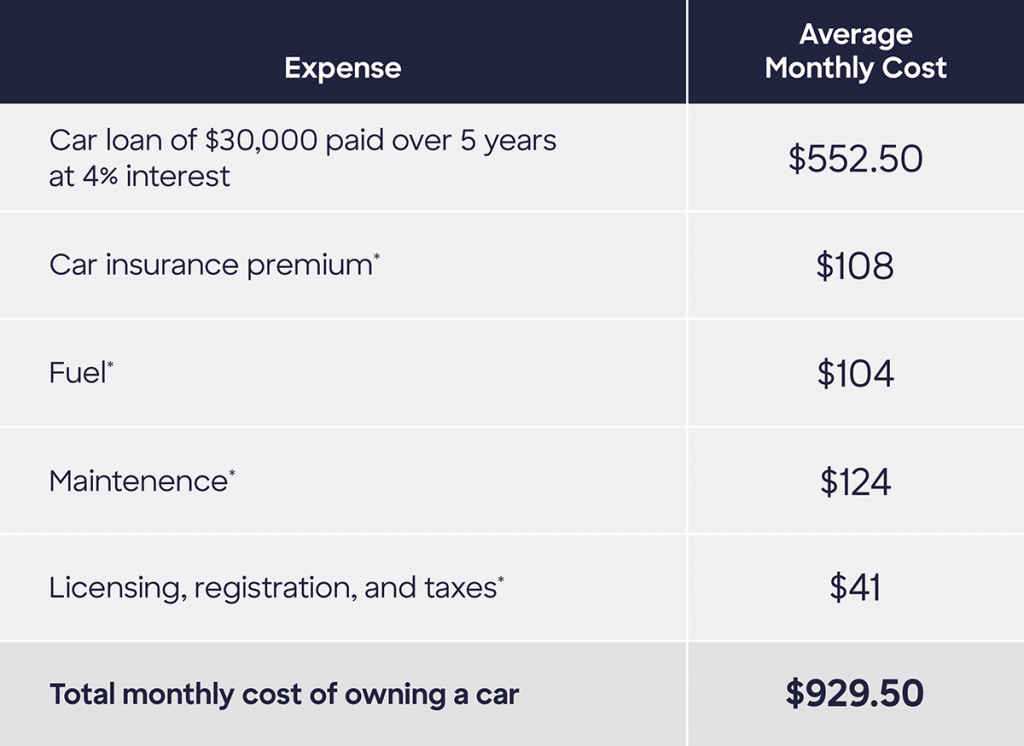

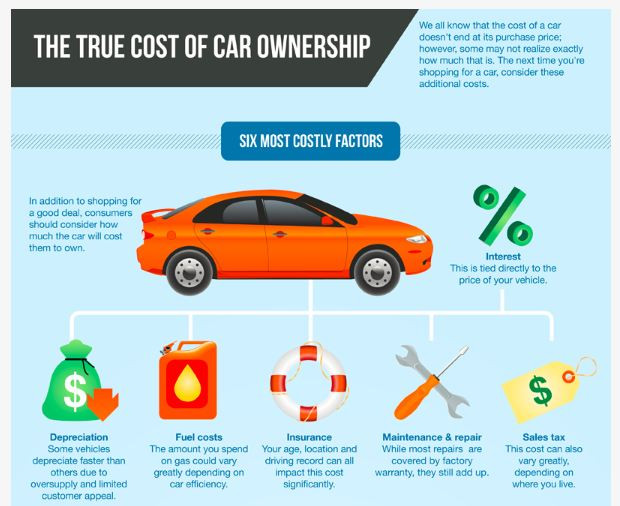

Keep in mind that your monthly payments are just a starting point. You’ll also need to cover gas, insurance, maintenance, registration, taxes and more. Watch this video to understand all of the costs you should consider when buying a car, and how to fit it into your budget. What are the costs you should consider before buying a car? Let this.. The average monthly payment on a new car was $738 in the fourth quarter of 2023, according to credit reporting agency Experian. Leasing a new car was cheaper at $606 a month, and owning a used car.

Cost of Owning a Car Discover Personal Loans

The Costs Of Owning A Car Are You Spending 7K to 11K each year? Money Lessons, Money Tips

Total Cost of Vehicle Ownership per Brand Car Sales Cambridge

Email This BlogThis! Share to Twitter Share to Facebook

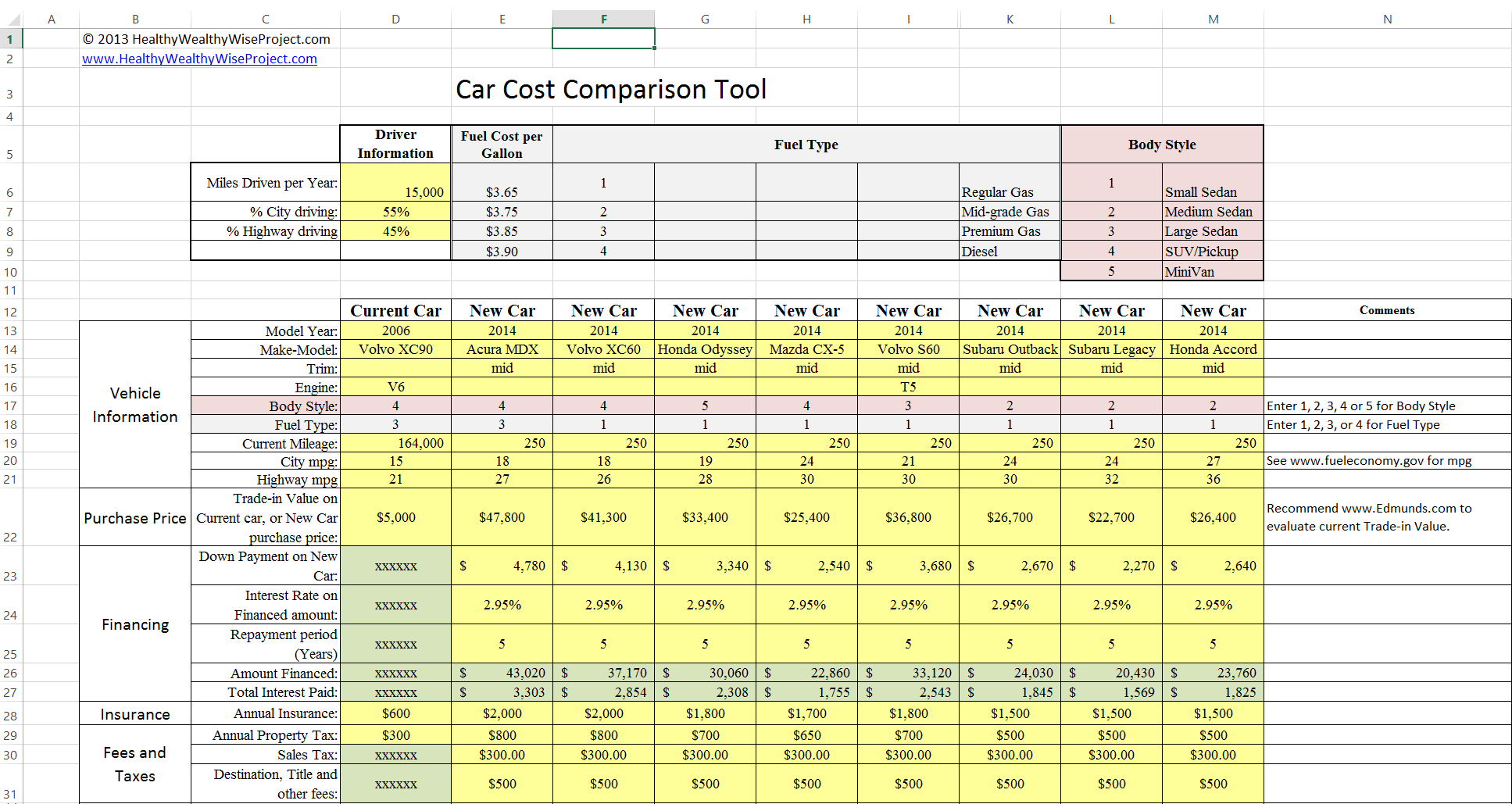

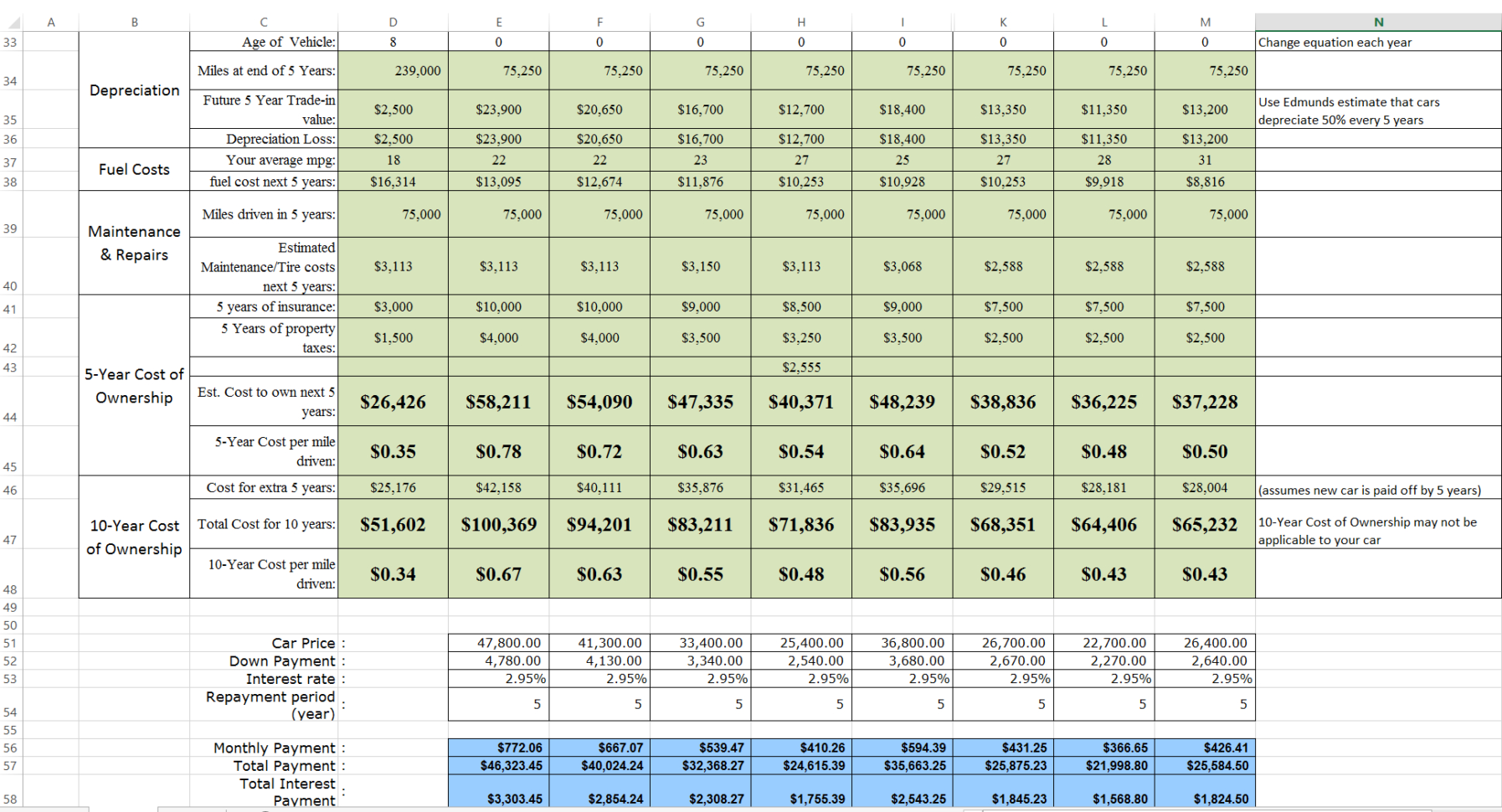

Car Cost Comparison Tool for Excel

How SelfDriving Cars May Save You Money Esurance

Car Cost Of Ownership Spreadsheet —

10 Things To Look Out For When Buying A New Car

Consumer Reports Electric Vehicle Total Cost of Ownership Savings Breakdown — My Money Blog

The True Cost of Owning a Car Budgeting for Vehicle Expenses Finance Rites in English

The True Costs of Owning a Vehicle in 2023 PensacolaVoice Magazine 2023

The True Cost of Owning a Car RateGenius

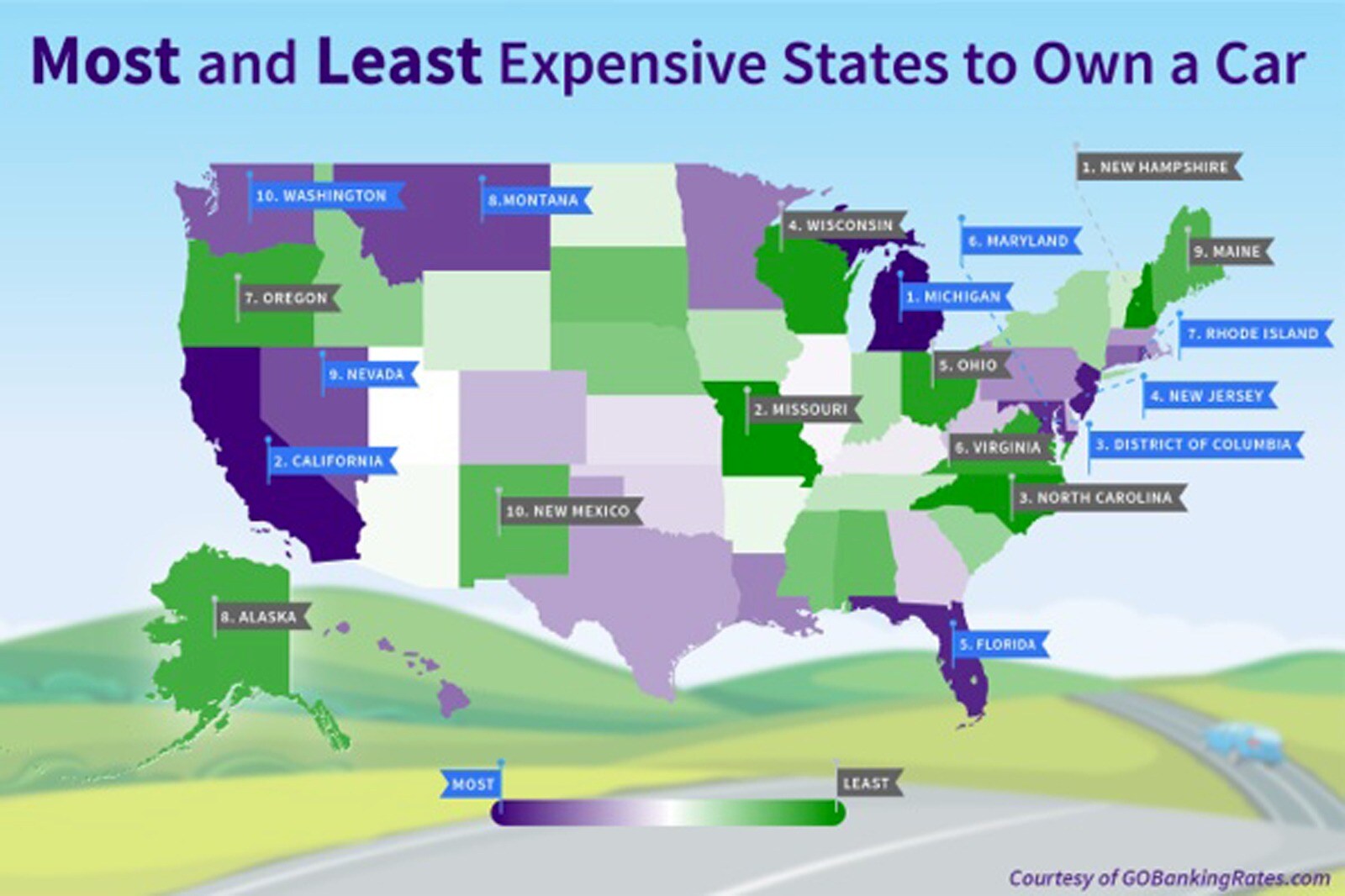

Fact 694 September 26, 2011 Costs of Owning a Vehicle by State Department of Energy

Cost of Owning a Car

The True Cost of Owning A Car Total Car Cost EINSURANCE

Cost of Car Ownership Calculator — Playing With FIRE

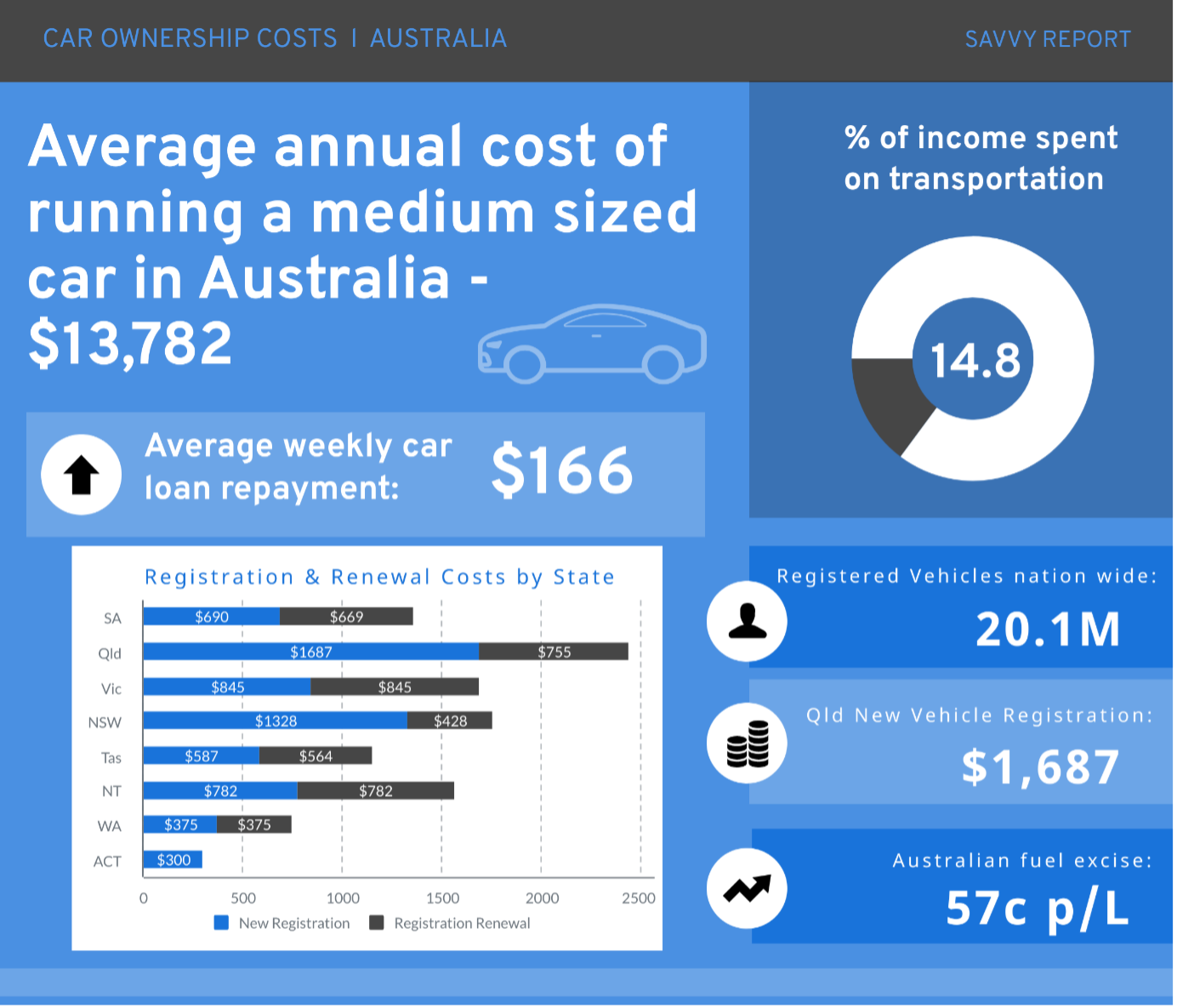

The Cost of Owning a Car in Australia

Cost Of Owning A Car In Singapore Over 10 Years

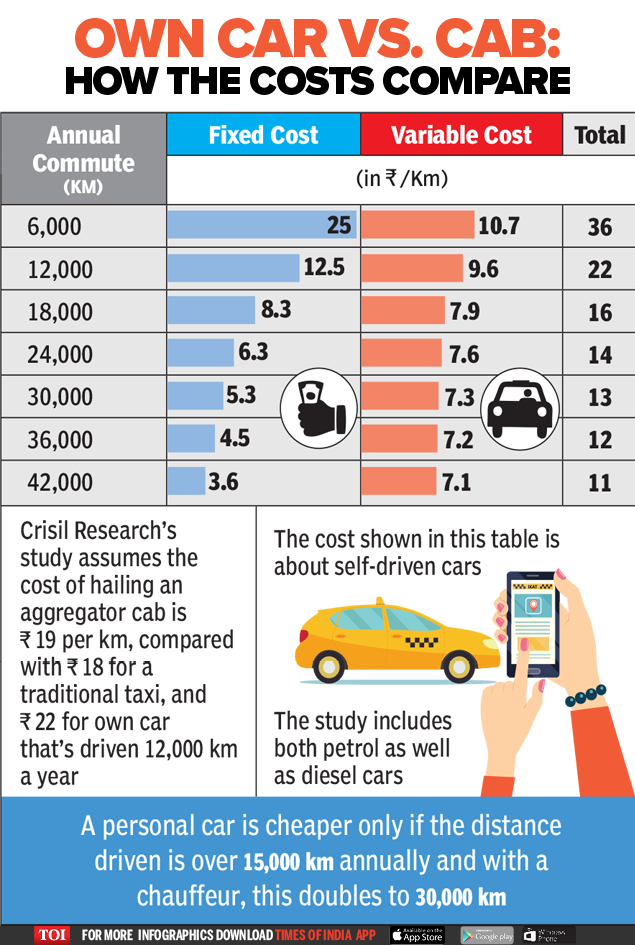

Infographic Driving your own car costs more than a cab Times of India

New Survey Calculates Average Costs of Car Ownership Edmunds

The costs of owning a car are depreciation, insurance, fuel, maintenance, loan interest and state fees. See how these expenses vary between different car brands and models.. These 5 major vehicle ownership costs vary greatly by brand and model. So, we’ve evaluated the total cost of ownership for over 250 vehicle models for you. Each.. The 7 true costs of car ownership. 1. Monthly financing or lease payments: ~$450/month. Naturally, your first big expense will be your monthly loan or lease payment. Let’s say you purchase a used 2019 Toyota Camry for $25,000 with 20% down. Your credit score is a solid 690, so you score 5% APR for 36 months.