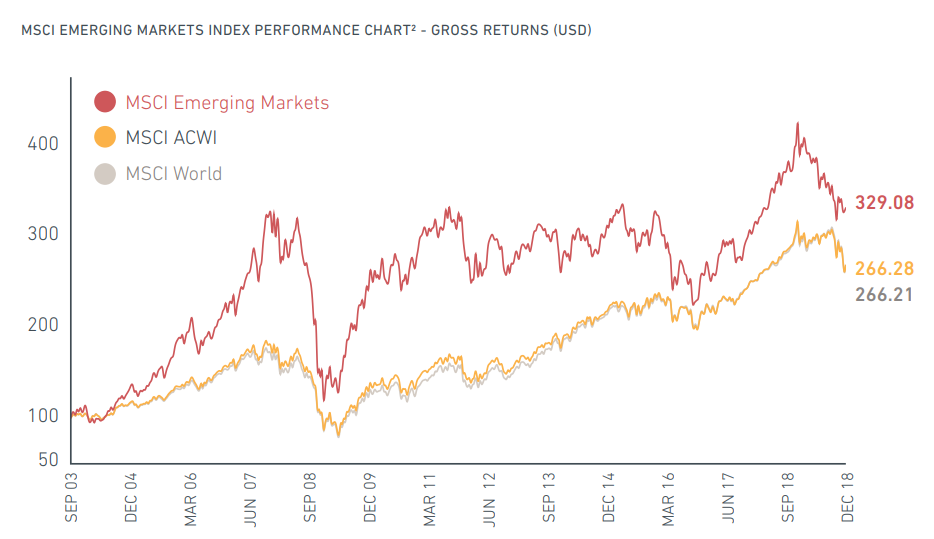

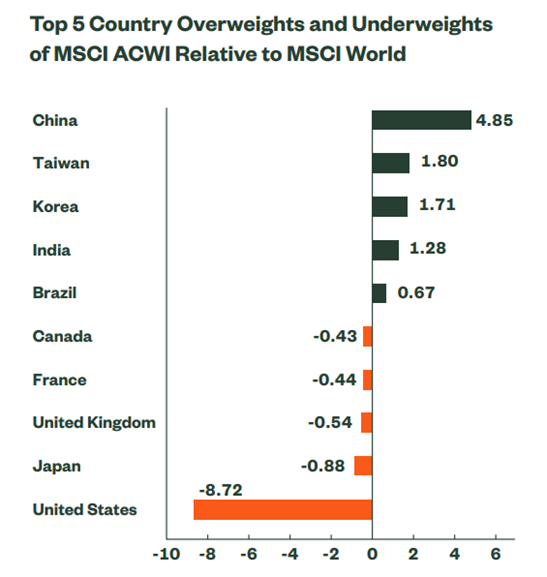

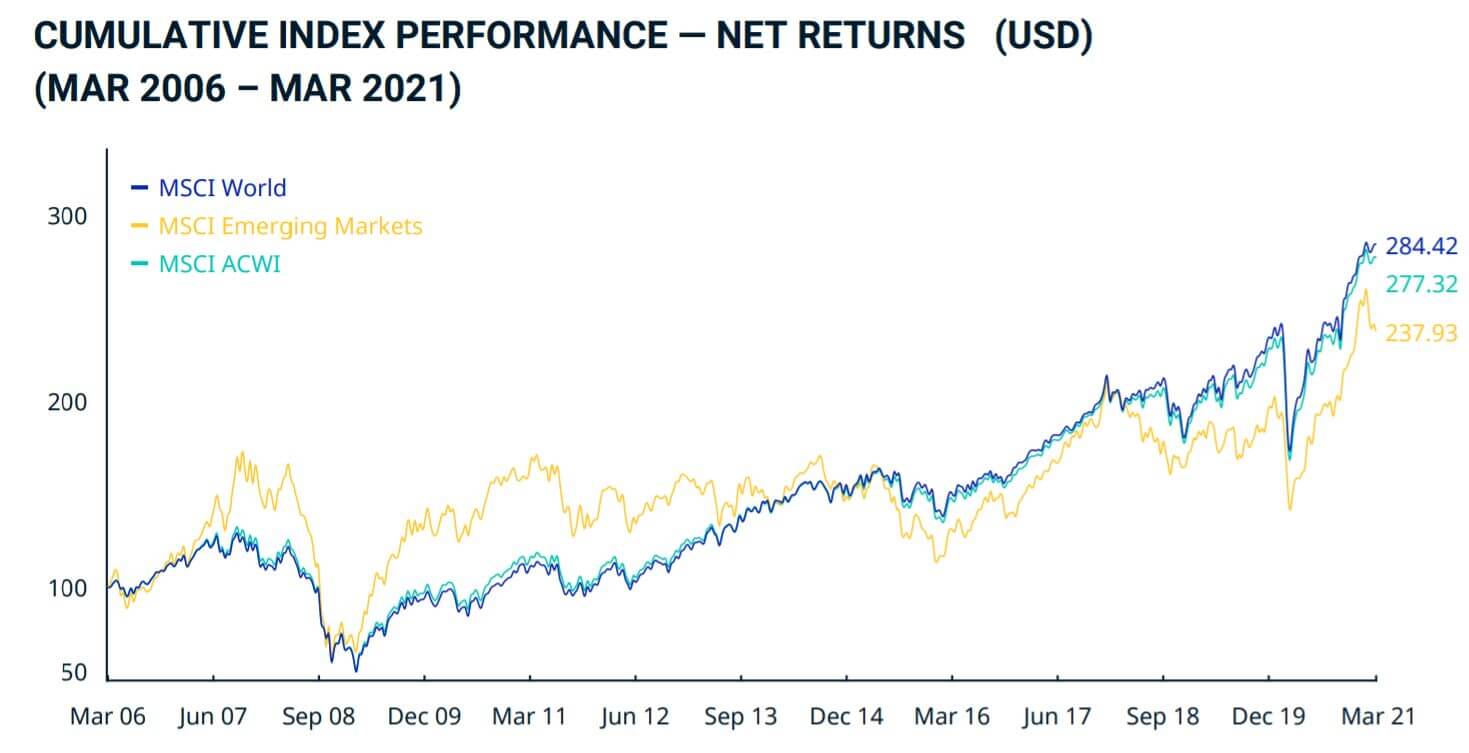

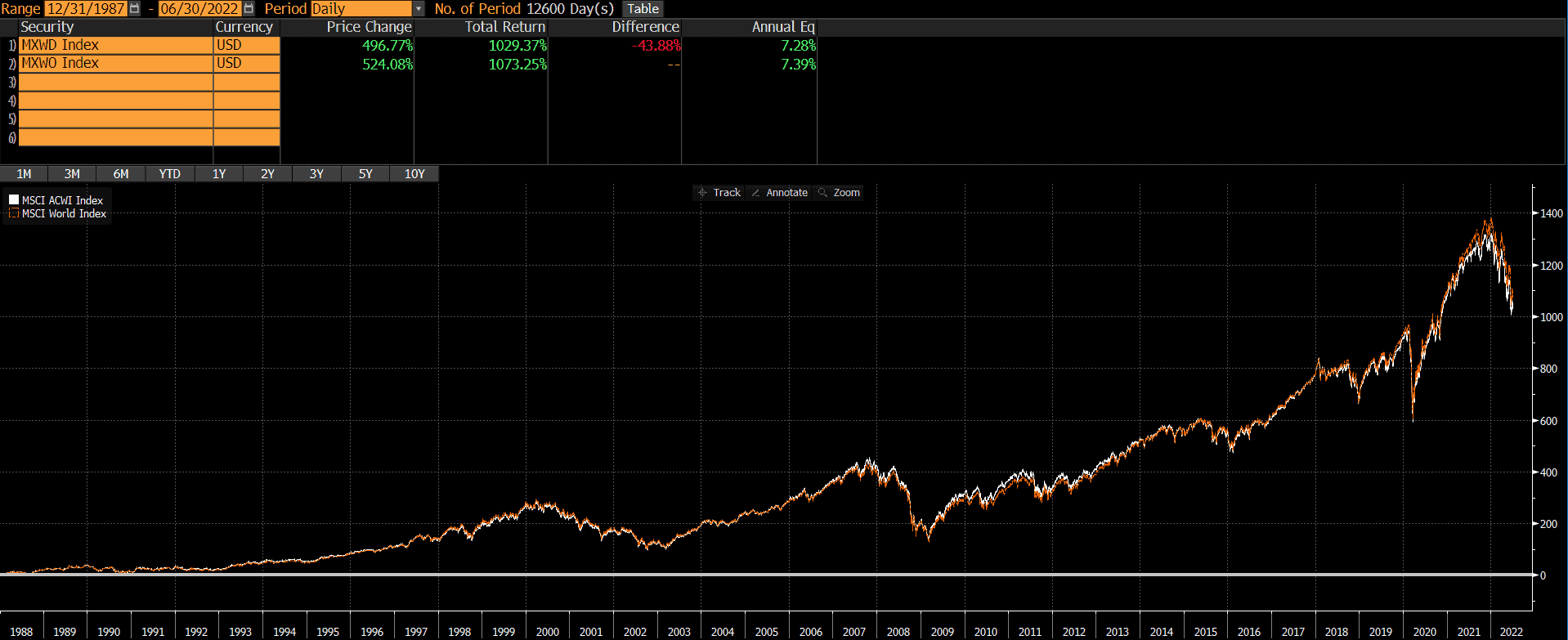

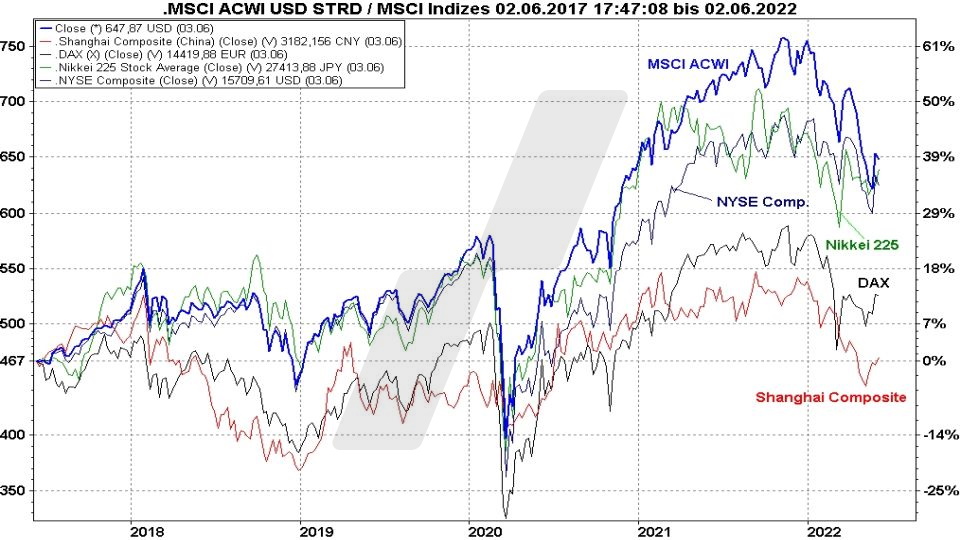

The MSCI ACWI index covers 85% of the global market capitalisation. It tracks about 3,000 large and mid cap enterprises in 23 Developed Markets and 24 Emerging Markets. However, the share of Emerging Markets in the ACWI is only around 11%, although these countries account for around 40% of the world’s gross domestic product (GDP).. MSCI World Price Index (1969-2020) Map of all countries included in the MSCI World index as of 28 Sep 2018 The MSCI World is a widely followed global stock market index that tracks the performance of around 1500 large and mid-cap companies across 23 developed countries. It is maintained by MSCI, formerly Morgan Stanley Capital International, and is used as a common benchmark for global stock.

MSCI ACWI IMI vs. MSCI World CAPinside

FTSE ALLWORLD VS MSCI ACWI Scrappy Finance

MSCI ACWI vs MSCI World welches Investment passt zu dir?… Flickr

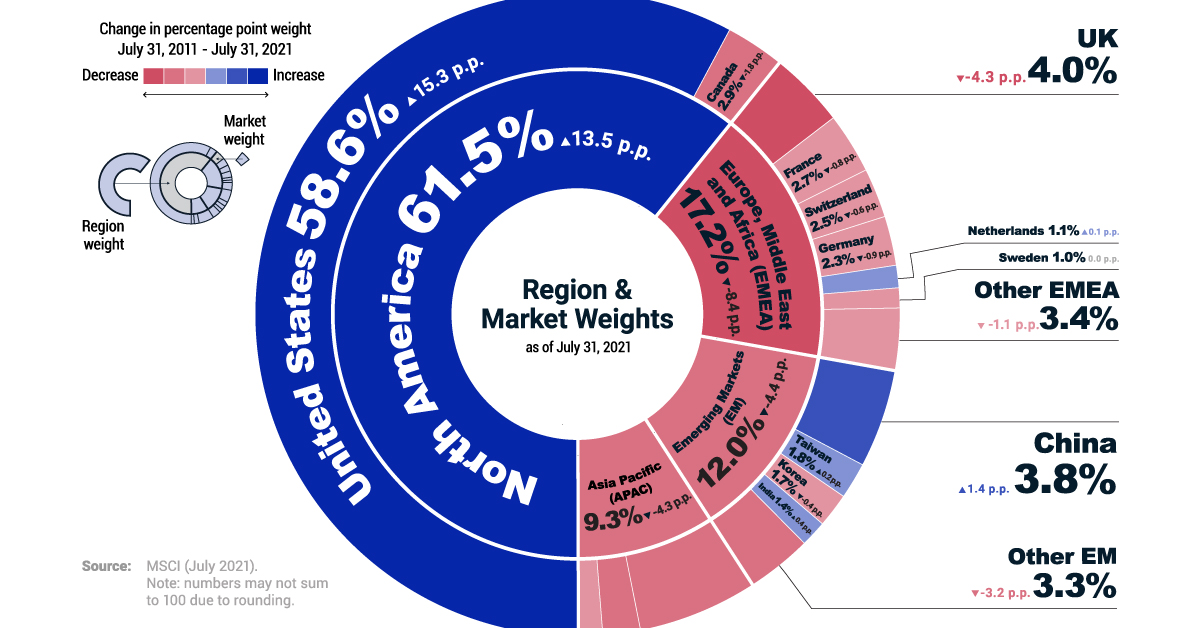

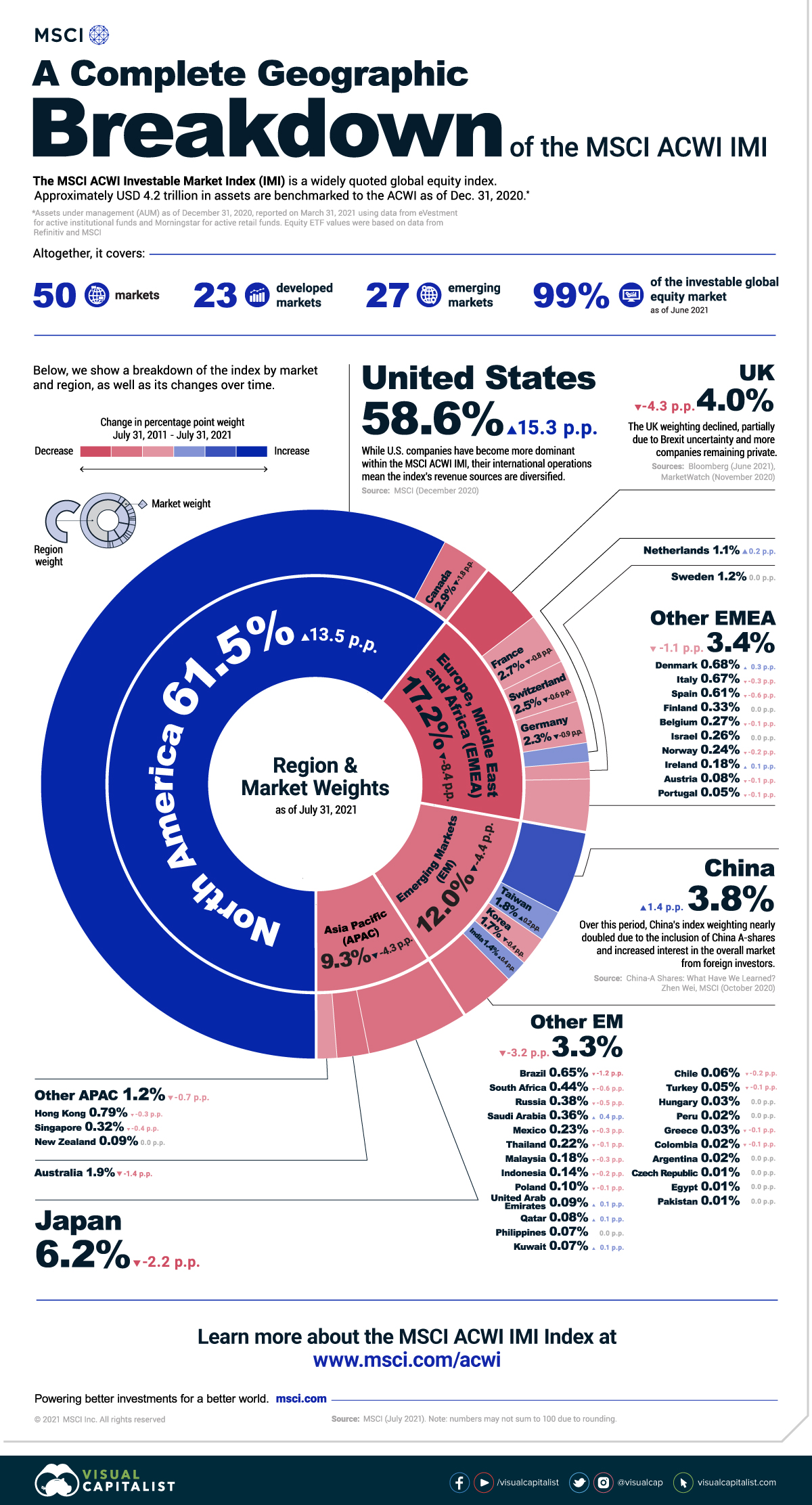

A Complete Geographic Breakdown of the MSCI ACWI IMI

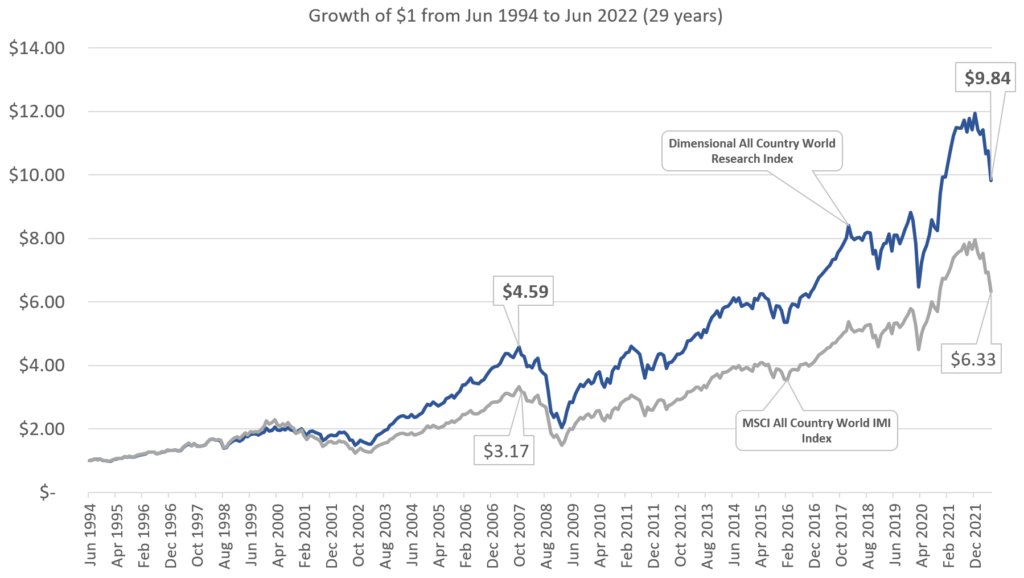

S&P 500 versus the MSCI All Country World Index and the Dimensional All Country World Research

¿Cómo indexarse al mundo? MSCI World vs MSCI ACWI Rankia

MSCI ACWI vs MSCI World quel indice est le meilleur

A Complete Geographic Breakdown of the MSCI ACWI IMI

Globale Aktien seit 1971 Das Renditedreieck für den MSCI World Index

MSCI ACWI(オールカントリーワールドインデックス)の特徴。先進国と新興国の株式に投資 東北投信

Rastreando Valor MSCI World vs MSCI ACWI

MSCI ACWI vs MSCI World Key Differences (2023)

S&P 500 versus the MSCI All Country World Index and the Dimensional All Country World Research

MSCI ACWI (All Country World Index) ETF vs. MSCI World + MSCI Emerging Markets Aktien ETF YouTube

📈 MSCI World vs. MSCI ACWI Akciová část PORTFOLIA (II. část) YouTube

MSCI ACWI vs MSCI World im großen Vergleich 2024

MSCI ACWI vs MSCI World Performance Differences (2024)

MSCI World vs MSCI ACWI Thoughtful Finance

MSCI All Countries World ETF Vergleich Die besten ETFs auf den ACWI 2022 Die besten ETFs

Liste aller Länder im MSCI All Country World Index (ACWI) FinanzTilo

The iShares MSCI ACWI ETF seeks to track the investment results of an index composed of large and mid-capitalization developed and emerging market equities. Next: Previous: Performance. Performance. Growth of Hypothetical $10,000 . Performance chart data not available for display.. In contrast, the MSCI World Index only tracks the performance of companies from developed markets/countries. MSCI ACWI is the best fit to gain exposure to emerging markets. If you prefer to gain exposure to developed markets only, MSCI World could be a good fit. In this article, we’ll explore the differences between these ETFs and examine the.